INFRA FUND - PROPELLING GROWTH TO THE NEXT LEVEL

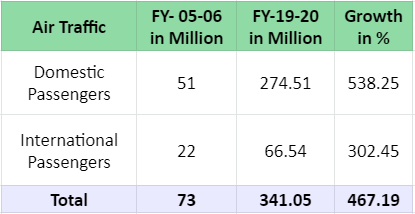

- Air traffic has registered a phenomenal 15-20% growth in India during the last 15 years and the country is today the third largest Aviation Market in the World.

- With an annual growth rate of nearly 11 per cent, the country will require airport development worth $100 billion in the next 10 years.

For the first time in India an Airport-Specific Fund of Rs. 10,000 crores (US$ 1.5 Billion) is being raised by TOFL to invest in Green Field and Brown Field Airports. The Fund has been approved by Securities and Exchange Board Of India (SEBI) as a Category II Alternative Investment Fund (AIF) under the SEBI AIF Regulations 2012.

Contributors – The Fund will invite contributions from banks, corporates, institutional investors, insurance companies, pension fund, higher net worth individuals and other investors in India or abroad as permitted under the AIF Regulations.

Target Size

The Fund will target capital contributions of Rs.10 million (Rupees One Crore) to Rs.10,000 Million (Rupees Thousand Crores). The Contributors shall make such Capital Contributions in accordance with the contribution agreement executed between the Trustee, the Investment Manager and such Contributor (“Contribution Agreement”).

The Trustee and the Investment Manager shall have the option, at their discretion, to raise Capital Commitments, subject to the maximum size of the Fund, not exceeding Rs. 100 Billion (Rupees Ten Thousand Crores).

Investment Objective – The primary objective of the Fund shall be to carry out the activities of a Category II AIF as permissible under the AIF Regulations, to make investments in Portfolio Companies and generate superior returns for the Contributors.

Investment Policy – The Fund will make Investments in Portfolio Companies from time to time in compliance with certain broad guidelines as set out below:

Nature of investments – The Fund will primarily invest in Portfolio Companies involved in green field, and brown field airports and aerotropolis consisting of hotels, IT parks, logistic parks, educational and medical services, convention centres, commercial and residential buildings. The Fund may also invest in other Securities as permitted under the AIF Regulations.

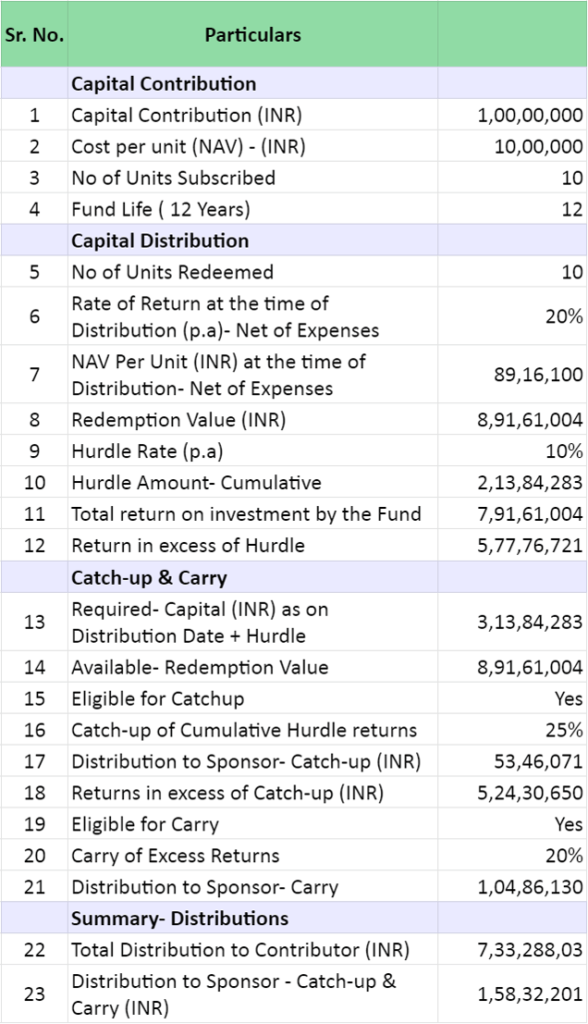

Target Return – The Fund will target Investments which will generate a gross investment internal rate of return (“IRR”) of 20% per annum on Investments, before taxation and all expenses. However, the Investment Manager does not provide any guarantee or assurance that the Fund will achieve its targeted IRR.

RETURN ON INVESTMENT (ROI)

Taking Off To The Future Investment Management LLP (“Sponsor” or “Investment Manager”) is the sponsor and the investment manager of the Fund. The Sponsor/Investment Manager was incorporated on December 6, 2018, and has its office at No.42, Kamaraj Avenue 1st Street, Adyar, Chennai, 600020.

The Trustee has appointed the Taking Off To The Future Investment Management LLP, to act as the investment manager of the Trust and its schemes under an investment management agreement dated December 20, 2018 (“Investment Management Agreement”).